Get the free maryland cor 92 form

Show details

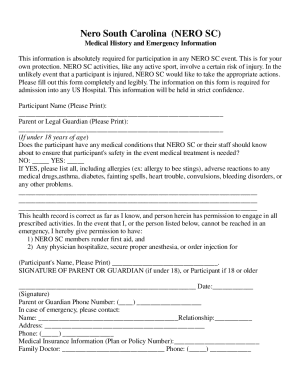

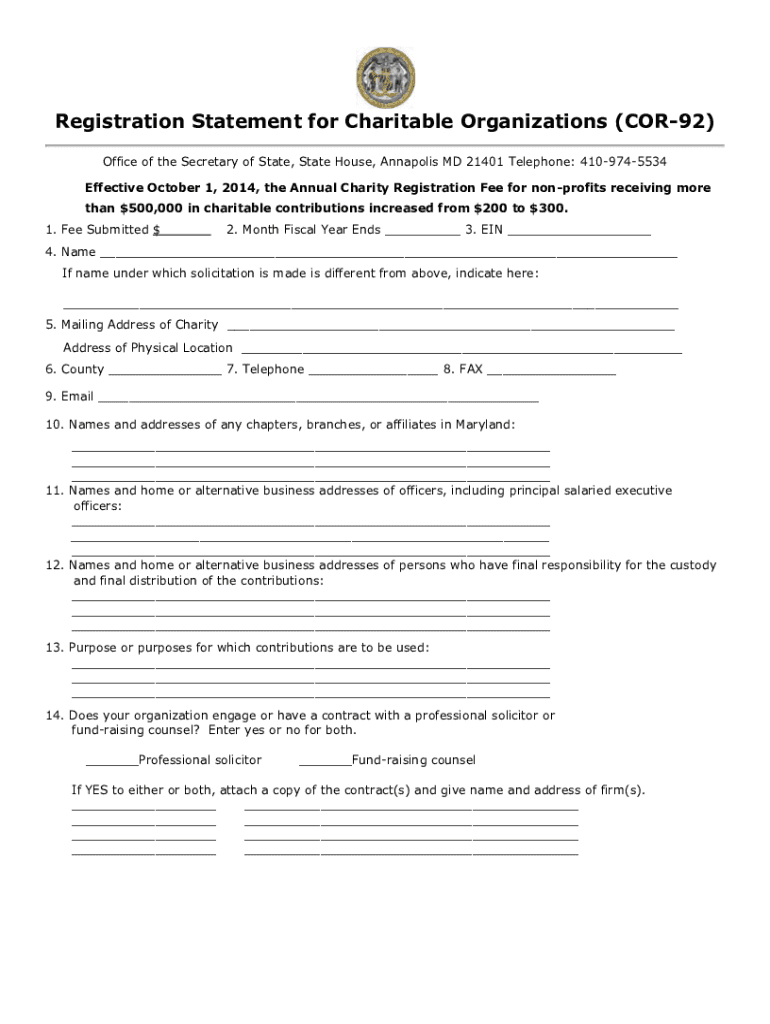

I have attached all forms required in the instructions for registration. Affidavit I solemnly affirm under the penalties of perjury and upon personal knowledge that the contents of the foregoing COR-92 and each supporting document are true. Directions for completion of this form the Registration Statement for Charitable Organizations COR-92 If fee submitted please enter amount of fee submitted along with this form. If you are unsure of your registration fee please refer to the table at the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your maryland cor 92 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maryland cor 92 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maryland cor 92 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cor 92 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

How to fill out maryland cor 92 form

How to fill out maryland cor 92:

01

Start by obtaining the maryland cor 92 form. This form can usually be found on the website of the Maryland Comptroller's Office or obtained from a local office.

02

Carefully read the instructions provided with the form. It is important to understand the purpose and requirements of the maryland cor 92 before filling it out.

03

Gather all the necessary information and documentation required to complete the form. This may include personal information, financial records, and any other relevant documents.

04

Begin filling out the form by entering your personal information in the designated fields. This may include your name, address, social security number, and other relevant details.

05

Move on to the financial section of the form. Provide accurate information regarding your income, expenses, assets, and liabilities. Take your time to ensure all numbers are entered correctly.

06

If applicable, fill out any additional sections or attachments required by the form. This may include providing details about your business or specific transactions.

07

Review the entire form once completed to ensure that all information is accurate and complete. Double-check for any errors or missing information.

08

Sign and date the maryland cor 92 form in the designated area. Make sure to follow any additional instructions provided regarding signatures or notarization.

Who needs maryland cor 92:

01

Individuals who are required to report their state taxes in Maryland may need to fill out maryland cor 92. This may include residents, non-residents with income from Maryland sources, and part-year residents.

02

Business owners who operate in Maryland may also need to complete maryland cor 92 for tax reporting purposes. This includes businesses of various structures, such as sole proprietorships, partnerships, corporations, and LLCs.

03

Individuals or businesses that have received income from Maryland sources, such as rental properties or earnings from Maryland-based employment, may need to fill out maryland cor 92.

Please note that the maryland cor 92 form may not be applicable or required for everyone. It is essential to consult with a tax professional or refer to the official guidelines to determine if you need to fill out this form for your specific tax situation in Maryland.

Video instructions and help with filling out and completing maryland cor 92

Instructions and Help about md cor 92 registration charitable organizations printable form

Fill cor 92 fillable : Try Risk Free

People Also Ask about maryland cor 92

How do I register a charity in Massachusetts?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is maryland cor 92?

There is no specific reference to "Maryland Cor 92." It is possible that it might be a typographical error or a specific reference that is not widely known. It is advisable to provide more context or clarify the term to receive a more accurate response.

Who is required to file maryland cor 92?

I couldn't find any specific information regarding a "Maryland COR 92" form. It is possible that you may be referring to a different form or document. Can you please provide more context or clarify your question?

What information must be reported on maryland cor 92?

The Maryland COR 92, also known as the Change of Resident Status Certification, is used by Maryland taxpayers to establish their residency status when filing state income tax returns. The following information must be reported on the form:

1. Personal Information: The taxpayer's full name, Social Security number, spouse's full name (if applicable), and the current mailing address.

2. Previous Address: The complete address of the taxpayer's previous residence or domiciliary address.

3. Current Address: The complete address of the taxpayer's current residence or new domiciliary address.

4. Date of Change: The date when the taxpayer's residency status changed or the effective date of the new domiciliary address.

5. Explanation: A detailed explanation of the reason for the change in residency status, such as a move to Maryland, change in employment, retirement, etc.

6. Supporting Documentation: Any supporting documentation that confirms the change of residency or new domiciliary address, such as a lease agreement, utility bills, mortgage statement, etc. These documents help establish the taxpayer's residency status.

The COR 92 form is required to be filed with the Maryland Comptroller's Office along with the taxpayer's state income tax return to establish the correct filing status and determine the appropriate tax liability.

How can I manage my maryland cor 92 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your cor 92 form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make changes in md cor 92?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your cor 92 form maryland to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit cor92 on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit md form cor 92.

Fill out your maryland cor 92 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Md Cor 92 is not the form you're looking for?Search for another form here.

Keywords relevant to maryland cor 92 pdf form

Related to maryland cor 92 statement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.